Current Economy

With the current economy, I know most of us are all feeling the financial pressures. Property taxes are high. Food costs have increased, and just overall, the cost of living. Even in my own personal life, things have been financially tight, debt piling up due to the cost of living, unforeseen circumstances, and issues that arose last year that we are still recovering from.

Financially Healing

However, I am learning about my relationship with money and learning to overcome certain mindsets and mismanagement. Not only am I on a healing journey, but I am on a financial mend, too. I am financially healing. Financial healing is a process of addressing and remedying unhealthy money patterns and relationships with money.

Some of the things I learned before and implement prior to us getting our home years ago helped me clean up my credit card debt and save money. So, I look forward to implementing these strategies again and applying such discipline this time around.

Discipline

One of my disciplines was to pay back debt one at a time and at least one debt paid back a year. The word of God says owe no man nothing, except love, and I would be happy to repay each debt and become debt free.

Word of advice: Never take out a personal loan and don’t have too many credit cards. Remember, credit cards and loans are borrowed monies, and they thrive on interest rates. So, if you are looking to get credit cards, one or two are all you need. And repay any amount spent each month in full.

Another thing I do is to pay the smallest to the greatest debt. Paying the highest interest rates I do not favor. Why? Because you see more of a progress with the smallest amount versus the highest interest rate, and that does something for your heart and morale when struggling with debt.

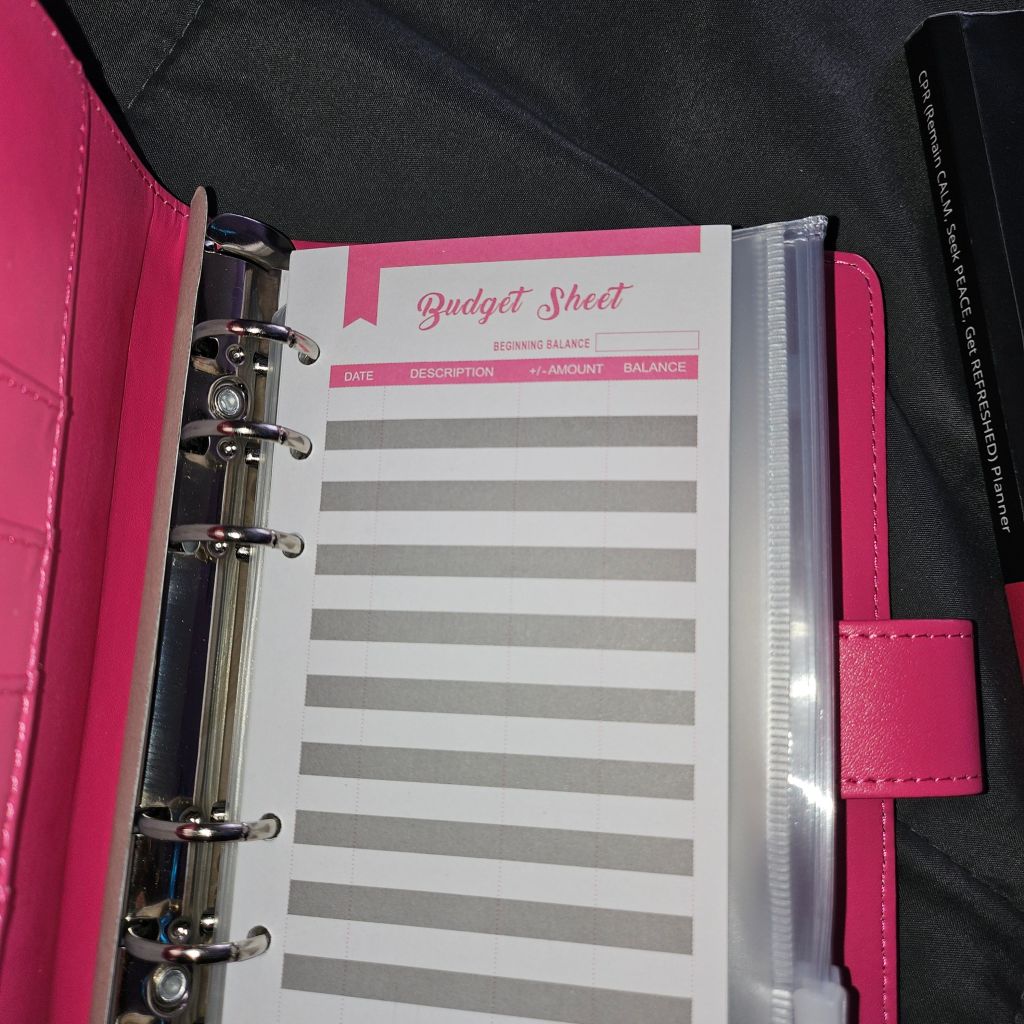

The second thing I am reimplementing is a budget. I have always used an Excel sheet as my budget tracker to map out my bills, expenses, and so forth. But after learning from a financial advisor that you have to create a budget that suits your lifestyle and not just your bills, that has been a game changer. And I pray to stick to my budget because I don’t, especially when using my debit card. So I plan to budget and try my best to stick to it.

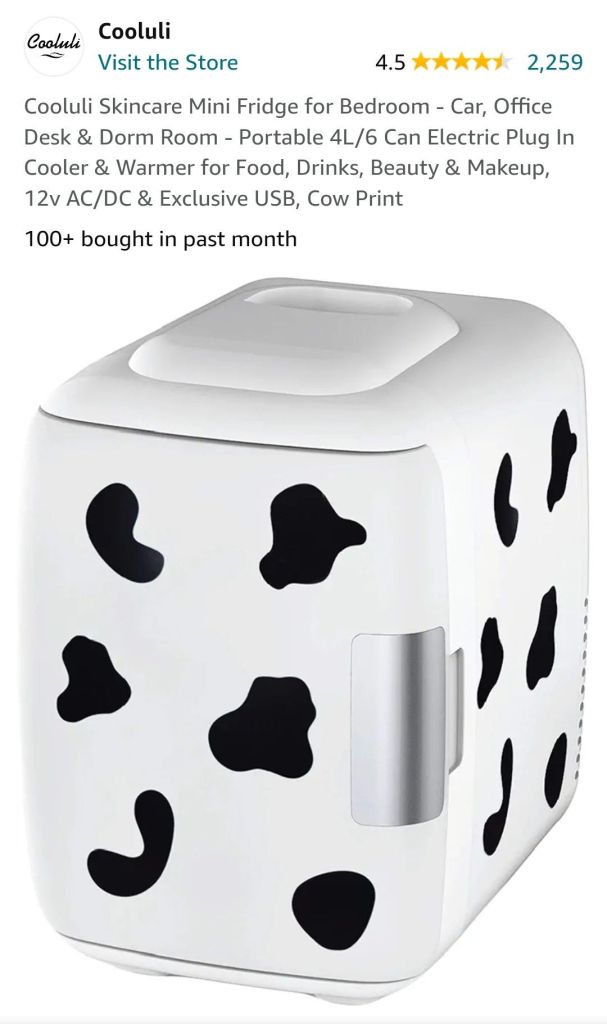

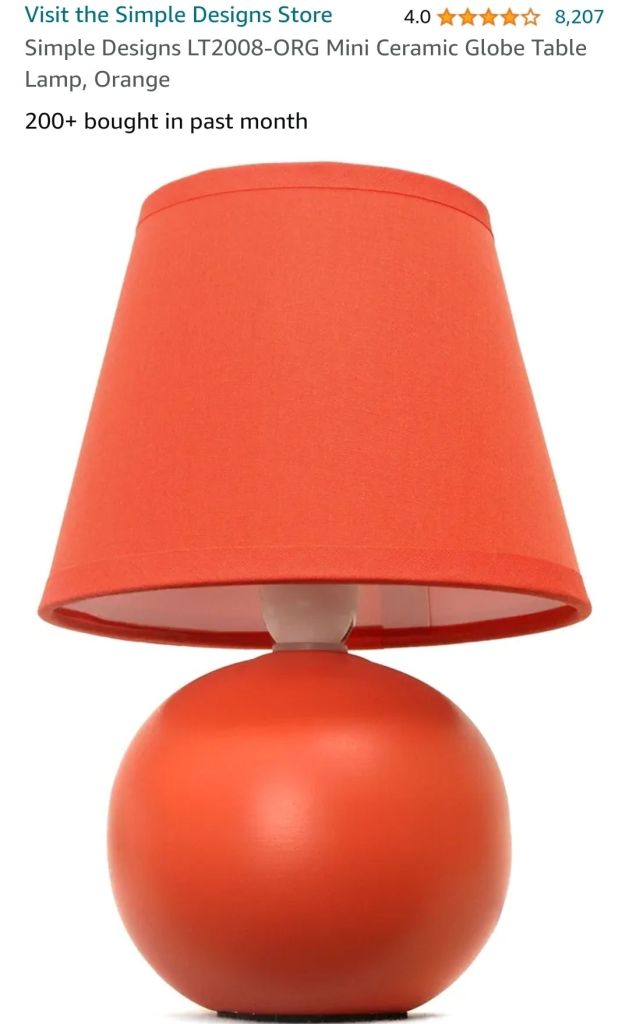

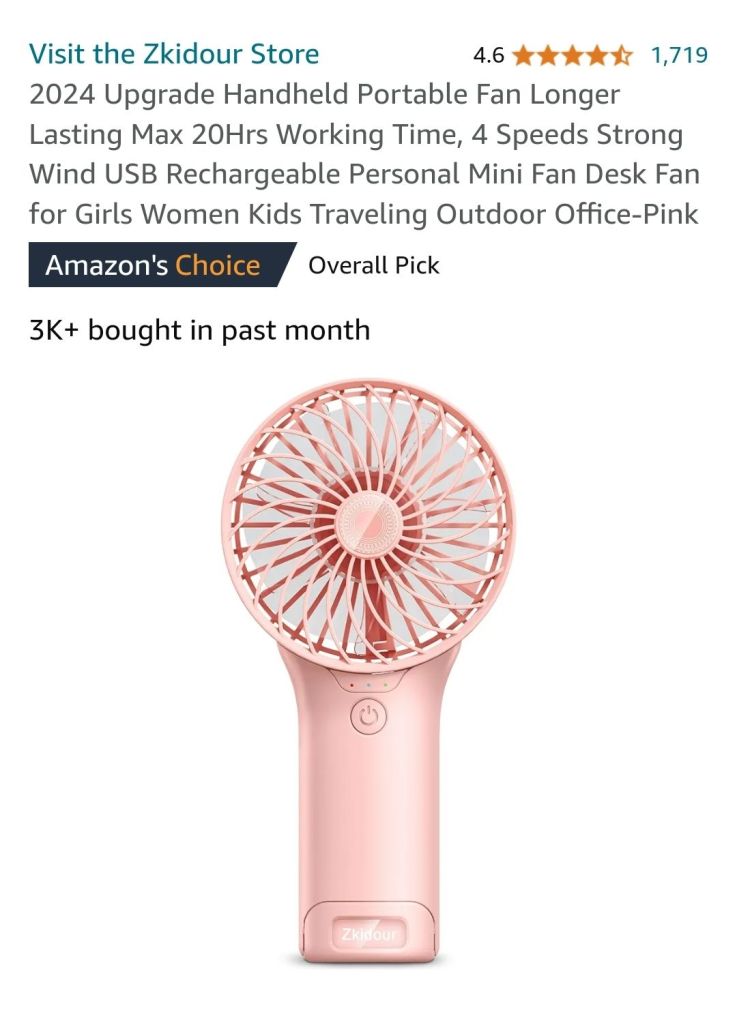

I am not new to sharing on my platforms great products I have come across and use in my everyday life, but now I get to share them and earn a commission. I value your trust above everything else, and I want to be upfront with my new endeavor. I’m in the Amazon Associates program, and some of the links in this post are affiliate links, which means I may earn a small commission if you click and buy. But I promise I only recommend products I truly believe in and think will add value to your life.

Dave Ramsey

I also plan to go the Dave Ramsey route and use cash more. Using my debit card or credit cards, it is easy to over exceed your budget and not stick to it.

Trust God

Another thing I plan to do is work on doing the homework to mend my finances. I have also been working on investing more or diversifying. And eventually, I want to start a garden. Lastly, I plan to trust God and try not to let the current economy crisis worry me. My God shall supply my needs according to His riches in glory.

Stand on Business

Now, for some other financial tips, try to save an emergency fund, save for retirement, and also get your affairs in order like getting term or life insurance. I know no one wants to think about these things or dont always have the wriggle room to save like they need or want to but start somewhere. As adults, we have to plan ahead, be responsible, and be good stewards.

Reflection

What are some changes you are looking to make to better steward your finances?

Disclaimer

We, at Fruitful & Fabulous/Tannika Nikeya, are not certified financial planners or financial advisors. We do research and reference the sources that we use within our writing. The information provided should not be used as financial advice; it is used to promote financial literacy, financial literacy based from the Bible as well as discussion. The views, some of the experiences, and opinions on this site are that of the authors. Any suggestions or investment advice should be reviewed by a financial professional before acting on them.

This website will never share your email address or any of your personal information with a third party for any reason. We are excited to encourage financial literacy and health but it is your choice whether or not you use the information provided and at your own risk.